The video is basically proportioned in three parts:

0:00 Explanation of swing lows and Fibonacci price levels.

3:19: Intermediate AB=CD targets.

4:239: Long Range AB=CD targets.

If precedent is prologue, as it has been since QE ran wild after 2010 and 2011 and all the other “twists and turns” of innovative, and reckless, Fed super-low or zero-percent-interest-rate policy moves, this rally could extend itself for quite awhile.

Here is the intermediate target (explained in the video):

Here is the long-range target (explained in the video):

But what about relative valuations?

The issue now is, how long can valuations be sustained if the bond market gets in trouble via profligate Federal spending? If China and the rest of the world dumps U.S. Treasuries, can rates remain low, or will that spell an economic downturn and a mean reversion in stock prices?

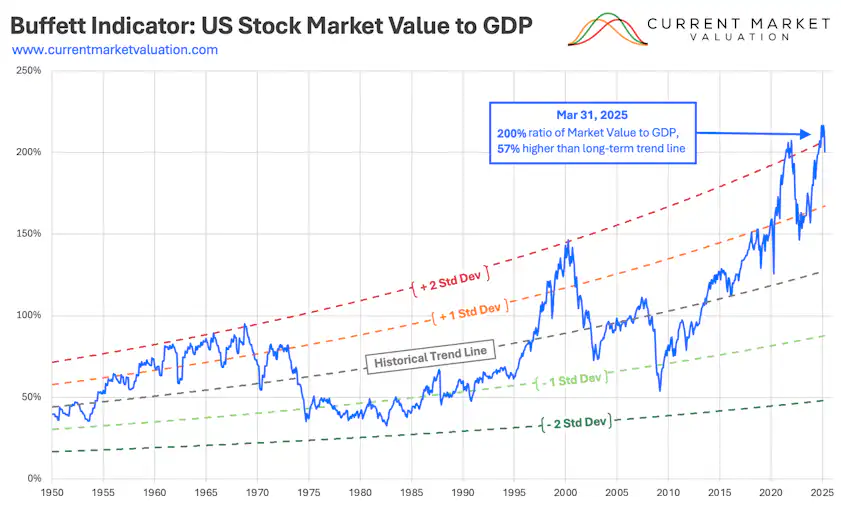

The Warren Buffett Indicator seems to be pegged to the 2 standard deviation upside of its range, as shown here, That is about as expensive as it ever gets on a stock-market-value to-GDP ratio.

And as you can see from this link, the overwhelming majority of return in the $SPX have come from Magnificent 7 stocks and not by general market strength. If the “generals” of the S&P 500 get whacked, so does the index generally. Those Magnificent 7 stocks are by no means bargains currently. The same will happen to the NASDAQ 100, as these stocks eat up a significant piece of market cap in that index.

I will get deeper into the bond market in the two series I am running (and the next installment of “Of Bullshit And Bitcoin” is next). There will be a mean-reversion of some magnitude coming. If you need to protect your retirement assets, then you need to sit down with a professional, or if you have strategies you run, you need to consider how to be defensive in the coming weeks and months. I think the fun could begin later this year, but again, nothing is certain. There is way too much going on domestically and in world geopolitics to be considered “calm” times.

That is all I will discuss at the moment. I will get deeper into the weeds in another Substack post!

Thank you as always for supporting the Buffalo Trader’s Writing Desk!

If you liked what you read, give it a like. As I mistyped earlier this week, I am still looking for those 1000 subscribers wanting to pay $8 a month for 20 to 26 posts a year, and not a MONTH, so that I can raise the level of research here into stocks and other investments. It will probably be October before I turn the paywall up permanently, but I am getting closer to pulling the trigger. Stay tuned.

Share this post