Even though QQQs and MNQH24 have all been bullish, the very confusion of news events and shifts in various sectors have been frustrating as seen in my first AI interpretation of a female trader at her trading desk, who somehow grew six fingers on one hand and the ability to hide her hand under the keyboard platform. I would think that trying to call bottoms and tops in the surges and collapses of news events within the 2023 rally might actually make one grow an additional finger on one hand.

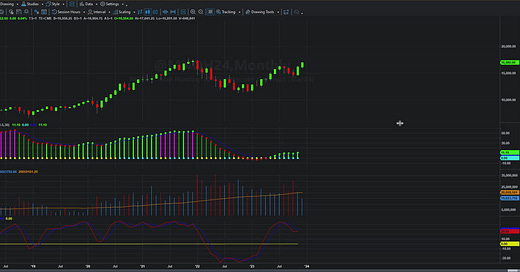

Please watch the video, as I go through the issues we have seen and may see with trading volume, and how the coming weeks and months may pan out if seasonality in this market normalizes. The monthly analysis begins immediately, the weekly analysis begins at 6:16 and the daily analysis begins at 10:35.

What is going to happen in 2024?

Well, if you believe the NASDAQ (their forecast somehow written up by The Motley Fool, which is still owned by the two founders Tom and David Gardner, which by the way, I do not endorse nor am I compensated by), the NASDAQ 100 should be up by 21% again in 2024. Their forecast includes the belief that interest rates will fall in 2023 that Amazon will benefit from continued “doom spending” and that Amazon will become more dominant in artificial intelligence (AI) as the year progresses. As that is being predicted, one must also realize that corporate and personal bankruptcies rising rapidly.

The QQQs and MNQH24 are dominated on a capitalization basis by seven very large-cap tech stocks, Alphabet (GOOGL; GOOG), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA). If things look decent earnings-wise for these stocks, then unless there is an utter catastrophe in the other 93 stocks, this index will continue to shine as long as the money keeps flowing in. Check the incredible performance of these names over time.

What could possibly go wrong with this index and MNQH24?

For one thing, I think interest rates will become a central issue to stock performance in 2024, just as it has since Chairman Jerome Powell first attempted to raise rates in 2018, causing the first volatility spike we had seen in the NASDAQ 100 in several years. It would appear that confidence to cut interest rates is still an issue at the Federal Reserve. History from the 1970s showed that when a lenient stance on rates was continued, inflation popped up again, particularly after the Yum Kippur War in 1973. Oil prices launched quickly after that as an OPEC oil embargo began.

The likelihood of an economy-impacting oil embargo this time is slim, as

has mentioned in several of his recent posts, numerous issues could “screw things up” for banking and the U.S. economy.For the Fed, if rates remain high or go higher, bond portfolios at regional banks will be under pressure. Because demand for U.S. 10-year treasuries has become slack, there is more pressure on the Federal Reserve’s reverse repo market to buy the excess, and that leaves the fund account for reverse repo purchases at low levels. That fund likely goes dry in Q1 2024, as explained in this video. If that happens, to increase demand for our ever-expanding and reckless Federal spending, interest rates will have to rise to increase sales. That will put pressure on everything including mortgage stocks and bond portfolios held by regional banks, individuals, and institutions. Suddenly, the Federal Reserve will be back in the continuous “doom loop” between bond prices and interest rates. Until someone with above-room-temperature IQ determines that spending must be cut, and Federal budgets be confirmed and managed annually and not 8 or 9 times a year as they are now, we cannot escape that “doom loop”. If the evacuation of the SWIFT system continues, it may also require an asset-backed currency to replace the U.S. dollar. Without such measures, interest payments on our debt will swallow every other expenditure we have, and the U.S. will have to deal rapidly with total insolvency, which technically it is in currently.

One potential stop-gap remedy for banks to earn a return is the use of the Bank Term Funding Program. All of that ends in March 2024, and it seems to be just a continuation of the props that led to the 2008 banking crisis. If the funding dries up, small banks and even large banks cannot arbitrage the difference between the repo rate and the bank term funding rate, and once again we could be back where we were in March of this year. We will in fairly short order know what happens there.

Do you like semiconductors? American industry does as does Chinese industry inside the PRC. Chairman Xi Jinping in no uncertain terms told President Biden that China would retake Taiwan. Since nearly 90% of the high-tech semiconductor chips come from that region, that would create havoc across every element of the tech sector including AI development. If the U.S. military was as strong as it was in 1990, this would likely not be an issue. Today, however, our assets are spread thin in Ukraine, Israel, and the Middle East, including Iran, as our military enlistment levels do not meet our needs. The U.S.A., if things thoroughly went south, could quickly be engaged in a four-front global conflict. I could post a library full of articles on those subjects, but you can do the same.

Politically, as state courts begin to bounce candidates not convicted of any crime, let alone ones that violate the 14th Amendment, off of state ballots, the risk of such ‘banana republic’ actions by both mainstream parties could bring havoc to our election process in 2024 and that is just a small measure of the caustic political environment in U.S. politics. You might want to stock up on popcorn, but options might also be a good idea to protect those long-only portfolios as well.

What Is My Conclusion?

I have no idea what will happen, but if you have followed my other weekend summaries, you know where my high and low estimates for market action in MNQH24 are. I think every rational human being knows that the ZIRP policy is one of the most dangerous things that world governments have thrust upon their citizens in all of world history. How we unwind this mess without destroying the liberties, wealth, and sanity of citizens begins in earnest this year. Who knows, it could be massively bullish or terribly bearish. The key is for one to be watchful, hedge where one can, and do one’s best to stay on course with your investing goals.

That is all from me this weekend. Have a very Merry Christmas and a happy prosperous and positive 2024!

Share this post