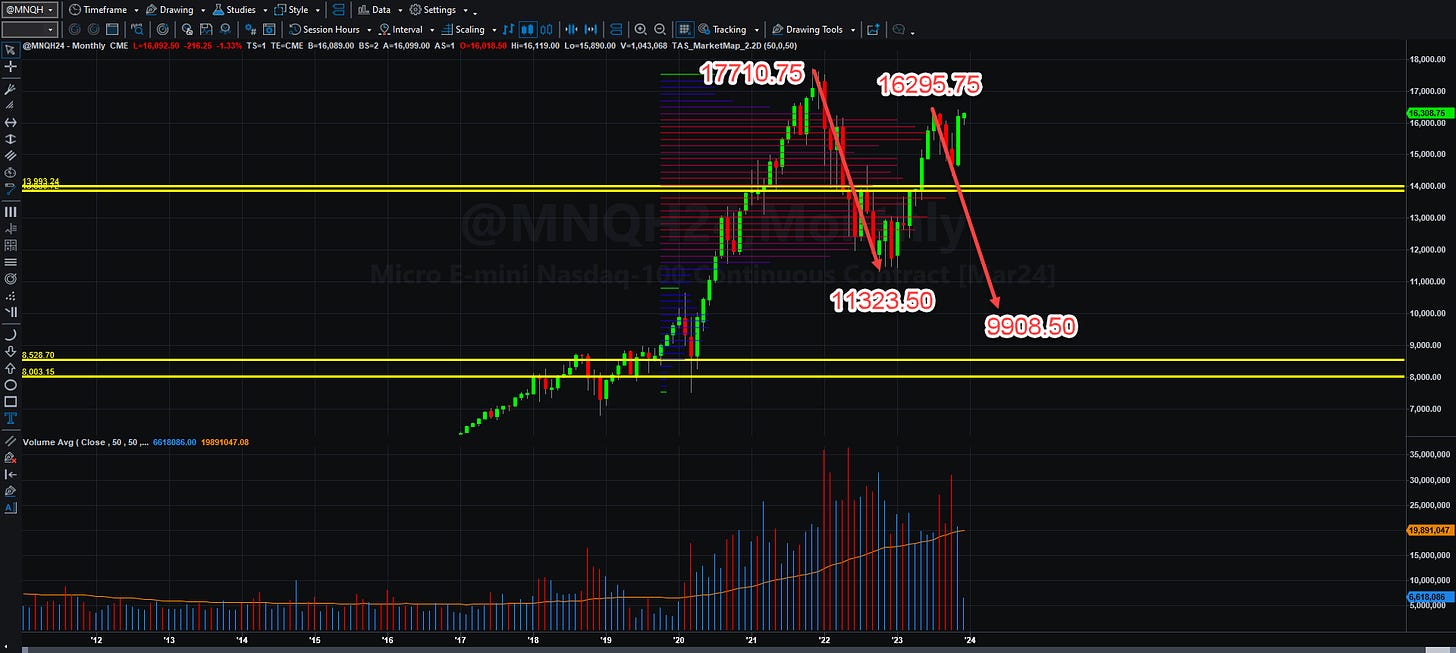

This entire video is dedicated to the monthly chart, not only because of time constraints, but also for the key focal point of any trend analysis and price projection going forward. If you can, WATCH IT.

The bullish projection for MNQH24 is 19483.75:

The bearish projection, if full AB=CD pattern completion happens is 9908.50:

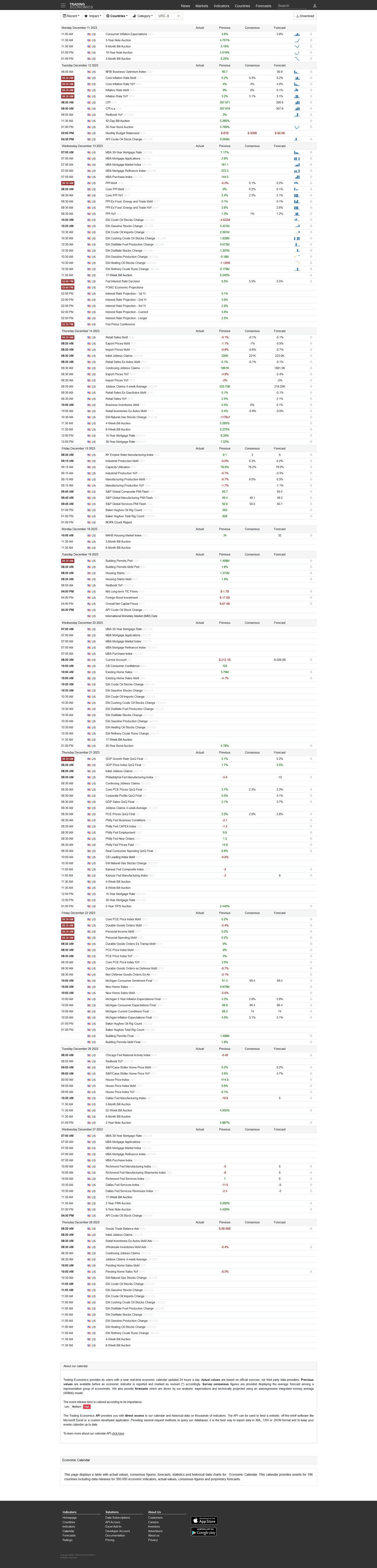

Which way will it go? I have no idea, however, much of the decision as to direction may well be determined by the PCE data, PPI data, which will indicate future downstream inflation. and the Fed rate decision data along with other Federal Reserve statements. That happens on Tuesday and Wednesday. You can find the dates on the economic data calendar from tradingeconomics.com below.

As with last month, most of the volume came from the final two weeks of trading, and it was largely centered around days like next Tuesday and Wednesday when major inflation-related data hits the street. That will probably happen again this month, but only time will tell.

In the daily posts, I have discussed the coming reverse repo market “collapse” or lack of funding. That is likely an early Q1 2024 event. Congress has no spending cap until January 2025. Everything being spent currently is being printed by the U.S. Treasury, which will add to inflation, and nearly guarantee current or higher interest rates. That will likely further credit crises, increase prices for an already tapped-out American consumer, and lead to an economic slowdown of some kind. World events could also reveal the outcome.

The best description of future returns is shown in this chart by John Hussman. The expected 10-year return of the SPX is below -6% per annum. We already know that 40% of the Russell 2000 have negative earnings, and the weights of the QQQ largely are composed of the old FAANG group of stocks, market-weighted. Those stocks are insanely overvalued on a forward basis.

There will be a mean reversion at some point. All that I can tell you is that if we take out 16460.25, MNQH24 has a very high probability of reaching new all-time highs. If it doesn’t, either we have a double top almost in place, or sellers could once again press this market beyond its swing low.

We will begin to get answers as the middle of next week unfolds.

Have a great weekend and a very productive week next week! Thank you for supporting this Substack!

Share this post