Please watch the videos, all of them. For my video (above), the monthly analysis begins immediately, the weekly discussion is at 7:04, and the daily discussion is at 8:31.

The key component is the adjustment of an bullish AB=CD pattern price target projection, based on all of the highs, lows, and pivot area prices that trading has established. Here is that chart:

That is a conservative projection, as only the most recent swing is measured against to provide the “D” price of the AB=CD pattern. That price is now 18213.25.

I could get into the deep weeds in terms of that the Fed can to do control interest rates, but one of them is active use of the reverse repo market. It is becoming more apparent weekly that foreign investors have lost interest in U.S. Treasury bonds, partly because of the rising risk of default over time, as expressed by Moody’s rating service.

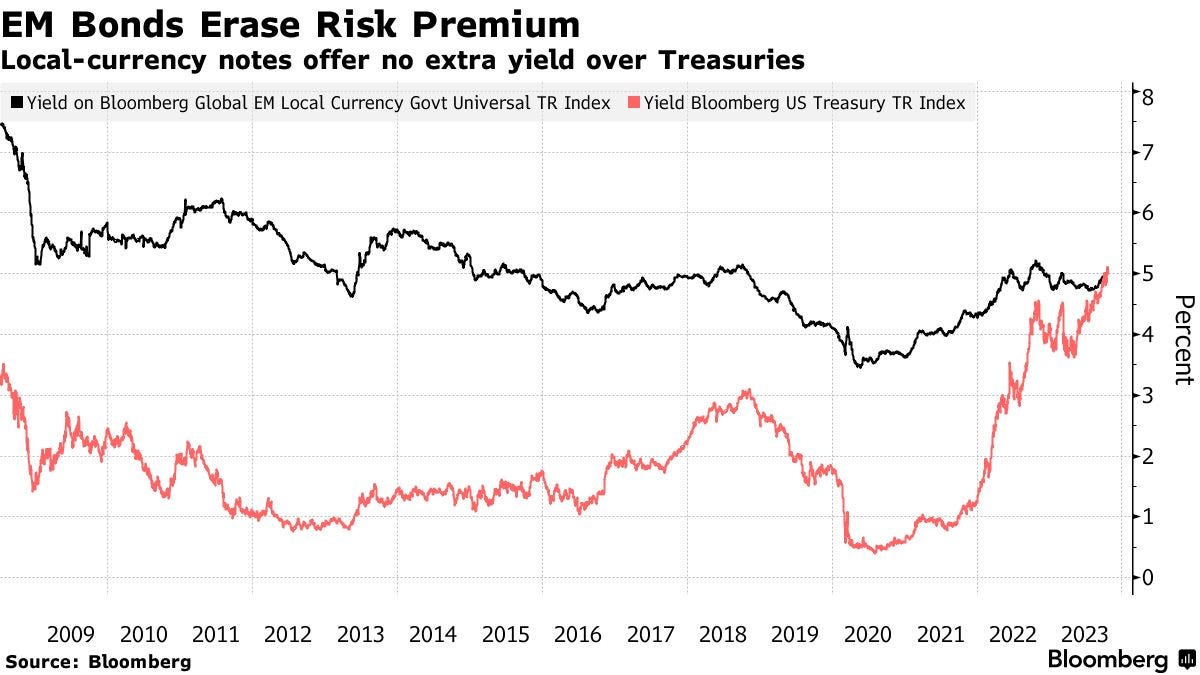

Because a November bond auction failed to fund the U.S Treasuries needs, the reserves required to fund operations are beginning to dwindle. When that fund dwindles, the immediate pressure on interest rates will drive them higher, and that will put pressure on banks, on Federal debt payments, and all other manner of interest rates in the general economy. The demand for U.S. Treasuries is declining, as yields for other international sovereign bonds with higher credit ratings than United States sovereign debt are become equal to or higher than our own, as shown in this chart:

The date for the exhaustion of the funds required to supplement a failed treasury auction could expire in the next 6 months or less, and that could lead to another financial crisis for the U.S. Treasury and Congress to handle. I could ramble about this forever and in detail, but I think it is best for you to watch this video and a subsequent video in which this situation and its implications are discussed.

The key points are, as long as “the print” on inflation data is assumed to be low, whether it is accurate or not, and interest rates can be stabilized, the stock market casino will remain open, and new highs could be made even in MNQZ23 and the QQQs under those conditions. However, if spending continues in an uncontrolled fashion with no budget cap and a string of six-weeks-less continuing resolutions are created by the U.S. Congress without a defined and permanently monitored and maintained ANNUAL Federal budget, we will see the continued rise in interest rates and debt. That will lead to the hyperbolic rise in interest payments which will eventually swallow the Federal government and the American economy. If the BRICS nations settle on a commodity-backed currency that becomes the world’s reserve currency, the American standard of living will indeed collapse in relatively short order. Our political class is blind to this prospect because it is self-absorbed with its desire for wealth confiscation and power. That needs to change and change SOON.

In other news, thanks to one reader, I am going to attempt to obtain some literature about geometric price implications of expanding price volatility, and to do some experimentation with volatility stops slightly unrelated to Donchian channels. If that analysis is tested and successful, it should allow me to hold “trader” contracts for more profits and for longer time periods.

I have tons to do this weekend, but I will report back on that later.

Thanks again for supporting this Substack. Have a restful weekend and an incredible week next week!

Share this post